- A USA TODAY analysis found thousands of underage bettors are caught annually by legalized sportsbooks.

- While sportsbooks file fraud reports with state regulators, consequences are rare, typically resulting only in a ban from the app.

Seventy-five dollars is all Sam needed for his next round of sports bets on his BetMGM app.

Well – it wasn’t officially his. He was 17 years old, and the legal gambling age in his home state of Arizona is 21. Sam used his mom’s ID behind her back to create the account where he’d bet on basketball and football games.

Except she found him out and reported him to the company.

BetMGM opened an investigation and found Sam had deposited $75 into the account with two ApplePay accounts. Investigators tracked his iPhone 13 to his home, but also the local high school where Sam had placed his bets. They banned the account and wrote up a report for state authorities.

But as soon as he was 21, Sam was back at it. Gambling on the apps again.

He’s just one of thousands of underage bettors caught annually by legalized sportsbooks like DraftKings and FanDuel. They collectively bet millions of dollars illegally, a new analysis shows. USA TODAY obtained and reviewed hundreds of the “suspected fraud reports” required by state regulators coast-to-coast to gauge the scale of the problem.

And while that oversight generates a mountain of paperwork documenting the fraud, virtually no one faces more serious consequences than a ban from the apps. Pending class action lawsuits alleged companies like DraftKings groom young men on their sites so they’re ready when they become 21.

Since the Supreme Court widely legalized sports wagering in 2018, the nation’s appetite for bets has flourished. U.S. bettors laid out about $160 billion in 2025 on sports, according to the outlet Legal Sports Report, creating revenue of about $16 billion. For perspective, an analyst pointed out Americans risked more on bets than they spend annually on movies, books, concerts and professional sports tickets — combined. On Feb. 8, Super Bowl 60 is anticipated to attract $1.7 billion in legal U.S. wagers.

The most coveted and lucrative market, young men 21-34, accounts for more than half of the bets placed on most sites. About 60% of those bettors place at least three bets per week.

Marketing for top sportsbooks floods the airwaves and casts a giant net for customers that critics say has lured high schoolers, college kids, as well as those legally allowed to bet. Experts worry watching sports has become conflated with betting the lines.

The underage fraud reports break into three buckets:

- Parents claimed children as young as 1-year-old accessed their account and placed wagers. In those cases, sportsbooks usually refund bets and ban the users.

- Underage bettors gain access using a relative’s account with or without their consent. This is the most common case of underage fraud.

- Underage bettors use an entirely stolen identity to create and operate accounts – this includes serious examples of fraud with deceased individuals’ social security numbers.

The sportsbooks say they’re doing everything possible and have robust KYC, Know Your Customer protocols. And yet, kids and teens are finding loopholes and tricks.

Betting on sites like DraftKings represents just a piece of the overall sports wagering landscape that includes other illegal routes for kids like offshore websites and in-person bookies with no age verification. Savvy kids are also finding their way to crypto “sweepstakes” sites and emerging prediction platforms with little or no age requirements.

Amount of youth wagering hard to pin down

The scale of underage betting is hard to measure. By one high-end estimate by McGill University, 60 to 80 percent of high schoolers gamble at least once in a given year with a smaller portion, less than 10% addicted or at-risk of developing a problem.

What’s easier to measure: the amount of underage reports filed with state regulators, as required by most state laws. USA TODAY obtained the reports from ten states, including some from Missouri, where sports wagering just went live Dec. 1.

State regulators in other states said the reports are considered confidential or not required, obscuring the scale of the problem they’ve pledged to prevent.

In Iowa, 84 reports of underage betting were sent to the state’s Division of Criminal Investigation − but it’s unclear if any got charged.

In Tennessee, sportsbooks notified the state’s Sports Wagering Council of 105 underage account usages in 2024. Last year, that number more than quadrupled. The council refers more than half of the reports to local district attorneys, but most take no action.

In Massachusetts, the state’s gaming commission requires companies to present data on underage access quarterly in public meetings.

DraftKings reported more than 4,807 underage registration attempts stopped last year and suspended 243 accounts that had placed illegal wagers in the state. FanDuel reported 186 attempts stopped and 330 suspensions.

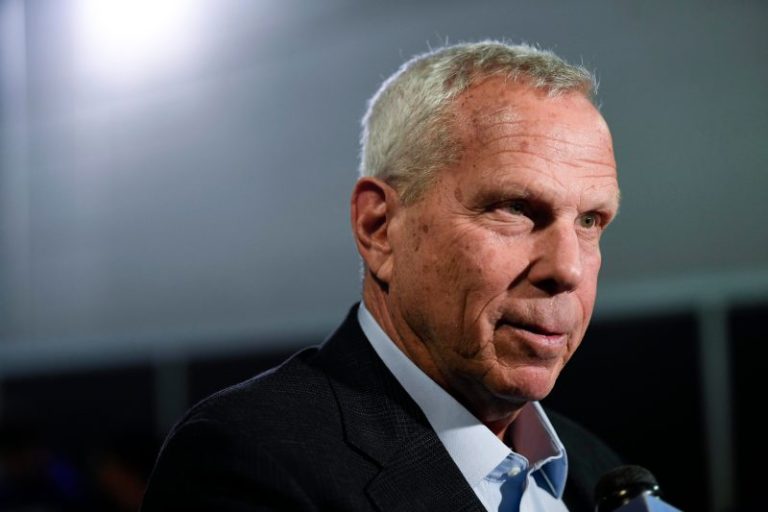

“We’ve got to figure this out because this isn’t getting any better, it’s getting worse,” Massachusetts’ Gaming Commission Chair Jordan Maynard said at a January meeting reaction to DraftKings’ report.

In Ohio, the state reports the dollar amounts associated with suspected underage accounts.

The Casino Control Commission told USA TODAY DraftKings by far had the most reports with 620, accounting for $2.78 million in wagers by suspected underage users since 2023. FanDuel had 162 underage reports, accounting for $63,152 in bets.

Both companies declined to answer questions about the total illegal amount wagered nationwide, but pointed out the suspended accounts would include the historical wagers on an account, so if it was illegally shared by an underage proxy better, it’s possible legal bets would be reported as well.

Underage bets also likely represent a tiny fraction of a company’s overall sportsbook handle, or wagers. But critics say DraftKings uses fantasy contests, legal at 18 in most places, to create a funnel to their lucrative 21-34 customer base. In the first nine months of 2025, DraftKings’ sportsbook reported $36.8 billion in bets, up 11% from the prior year.

‘DraftKings employs advanced Know Your Customer (KYC) technology trusted by the financial industry and law enforcement to verify the age and identity of our customers, in sharp contrast to predatory illegal and offshore operators,” said Stephen Miraglia a DraftKings spokesman. “Every sports wagering law and regulation establishes an age of eligibility, and DraftKings strictly adheres to these requirements in every jurisdiction in which we operate.”

FanDuel’s Cory Fox, senior vice president of public policy and sustainability, said the company has a “zero tolerance policy” for underage gambling and uses monitoring tools to identify misuse.

“When suspicious activity is detected, the company takes appropriate action, which can include restricting or closing accounts and reporting issues to law enforcement or regulators as required by law,” Fox said.

In 2025, FanDuel launched a “Trusted Voices” program aimed at educating parents and helping them talk to their children about gambling.

Wagers represent millions in illegal bets

Arizona alone provided nearly 300 of the underage fraud reports dating back to 2021 to USA TODAY.

This includes Brody’s story, a 16-year-old DraftKings customer.

Brody, who the paper is not identifying as he was a minor at the time, logged into the app to place a few wagers in 2024. He used an account with his dad’s name and credentials.

He made a critical error: depositing cash with his bank account, which showed he was underaged.

Mismatched names between the accounts triggered a red flag that led the betting giant’s fraud investigations unit to scrutinize the account. DraftKings swiftly used commercial data broker LexisNexis to identify Brody, his father, and soon located his high school page.

When reached on the phone, Brody’s father declined to speak to USA TODAY, expressing concern that the illegal betting could negatively impact his future college prospects. He was not charged with any crime.

Sam’s mother, Gloria spoke to USA TODAY about her experience turning her son in. Her last name is being withheld to not identify her son who was a minor at the time.

She said she was upset that the company didn’t have better safeguards to prevent it.

“I told him at the time: that’s it. This is done” Gloria told USA TODAY. “He tried to tell me how much money he was making, but that’s not the point. I was hardline, wait until you’re 21.”

Another report identified a highly-coveted frequent gambler assigned a personal host, who used BetMGM’s mobile apps to wager on sports. He was going out of town and messaged his VIP handler that his 18-year-old son would be wagering for him. The betting age in Arizona is 21. That triggered an investigation, lifetime ban and fraud report to the state. The illegal activity was filed away in Arizona’s system. The father told USA TODAY he simply didn’t understand the state’s law.

Some teens have been caught based on companies tracking their cell phones with the company GeoComply down to their high schools. Others tried using high school checking accounts triggering suspicion.

Arizona officials boast a robust paperwork collection protocol aimed to prevent, detect and stop underage gambling, said Suzanne Trainor, a Department of Gaming spokesperson.

“If a review identifies potential violations of statute, rule, or license conditions, the Department may take regulatory action against the operator, which can include corrective action plans, enforcement action, or other regulatory remedies as appropriate,” Trainor said.

They can also pass criminal referrals to law enforcement or prosecutors. Asked how many times punitive action has been taken against either patrons, underagers or companies, Arizona officials confirmed the total since 2021 is zero.

Regulators can only push so far

The way the legalized markets has burgeoned in the United States has created some odd realities, said Les Bernal, national director of the group Stop Predatory Gambling.

“State governments are partners to this industry and can’t push too hard because they’re making so much money. They’re like the arsonists and firefighters at the same time,” Bernal said.

Plus, most of the research and work around problem gambling is funding by the industry itself, again, “it’s like putting Dracula in charge of the blood bank.”

Bernal believes the country is facing a predictable epidemic of teens, kids and mostly young men who have normalized sports betting.

“We saw it in the United Kingdom and Australia, kids grow up today thinking sports and gambling are one in the same. You’re not a sports fan if you’re not wagering. It’s a transformative experience and it’s dangerous.”

The latest information from the National Council on Problem Gambling shows adolescent problem gambling leads to a complex mix of criminal behavior, poor academic achievement, truancy, financial problems, depression, suicide and substance abuse.

That leaves people like Maynard in Massachusetts partnering with the state’s attorney general to push legal operators to be better, while attempting to crack down on illegal markets.

And while they count the number of underage fraud reports and forward some to law enforcement, “I don’t think we should be putting kids in jail over this. It’s an opportunity to educate them and parents about harmful behavior,” Maynard said in an interview with USA TODAY.

“We have to use the regulatory toolbox and bully pulpit in our public meetings to be honest about this problem and what we can realistically do to tackle it,” he said.

Massachusetts has targeted limits on advertising, “to ensure Disney on Ice doesn’t have DraftKings ads next to it” and to monitor any advertising that is false and misleading. Sportsbooks have been targeted for “Can’t lose” parlays and “risk free bets’ by regulators and lawsuits.

“Is it worth it? Yeah, I know it’s an expense to the operators to count underage access, but the aim and goal of zero is worth it,” Maynard said. “Why are we here? Why do we exist: why am I doing this? It’s to make a difference.”

Tennessee is piloting a new intervention program from young people caught gambling, said Jim Whelan, executive director of the Tennessee Institute for Gambling Education and Research at the University of Memphis.

It funnels kids into a 2 ½ hour online assessment in lieu of the misdemeanor and $50 fine.

“The top two predictors of adult problem gambling are: you have a parent with a gambling problem and starting at a young age,” Whelan said. “Kids watching sports are inundated, so we need to help then learn how to manage that exposure.”

Youth voices have suggested solutions

Problem gambling agencies are slowly adapting tipsheets for parents, curricula for teachers and recruiting young voices to tell their stories to kids.

The New Jersey native said he battled a gambling addiction for the last six years, spending about eight hours per day on sportsbooks and online casinos.

“I don’t think a punitive approach to kids gambling will help, we have to work toward counter-messaging because FanDuel and DraftKings have great KYC, but a billion dollar marketing campaign,” Minnick said.

His message: You will lose betting on sports, and addiction can happen and needs to be taken seriously. He had to find group support, set-up financial controls (he went so far as to turn over his bank accounts to his mother) and sign up for self-exclusion lists.

Isaac Rose-Berman, 25, is a professional young gambler who has increasingly used his voice to warn about sports betting. He’s a fellow at the American Institute for Boys and Men who consulted on a study out last week by the nonprofit child protection group Common Sense Media.

The survey polled 1,017 boys nationwide 11 to 17 years old in July 2025. Of that group, 36% reported gambling in the last year. A third of the 11-year-olds reported wagering and nearly half of the 17-year-olds had. Most encountered ads for the platforms via social media and streaming video on YouTube.

Researchers found the teens were generally wagering small amounts: $54 on average across all teens who spent money on gambling over a year.

‘I only do things like that for fun,” a 16-year-old told the researchers. “I feel like I have enough willpower to quit any time. I think it’s very fun to do when you can limit yourself.”

Rose-Berman advocates for two policy changes: a crackdown on online casinos, legal in seven states and a restriction on ads.

“I just think you should be able to watch sports without the constant barrage of gambling ads,” Rose-Berman said. “Why don’t we have cigarette ads on TV? Because more than 10% of the audience is underage.”

While the youngest gamblers likely aren’t facing financial ruin — he worries the habits are having an impact on the social fabric of young society.

He can relate to the young men who wake up in the morning and immediately check their picks and constantly think about lines, like Sam, the Arizona teen once outed by his mother.

“It’s the stupidest thing ever, especially if you don’t have a lot of extra money to spend,” Gloria said. “He knows how I feel about it.”

Nick Penzenstadler is a reporter on USA TODAY’s investigative team working on national projects. Tips or questions? You can contact him via e-mail npenz@usatoday.com or on Signal at 720-507-5273

This post appeared first on USA TODAY