- Tampa Bay’s victory over Carolina did not decide the NFC South, leaving the division title still contested.

- The Atlanta Falcons now have a chance to create a three-way tie for the NFC South title with a win on Sunday.

The NFL runs a risk every May when its schedule comes out – hoping those “TBD” slots it reserves for the Saturday of Week 18 ultimately get filled by games worthy of the standalone broadcast windows.

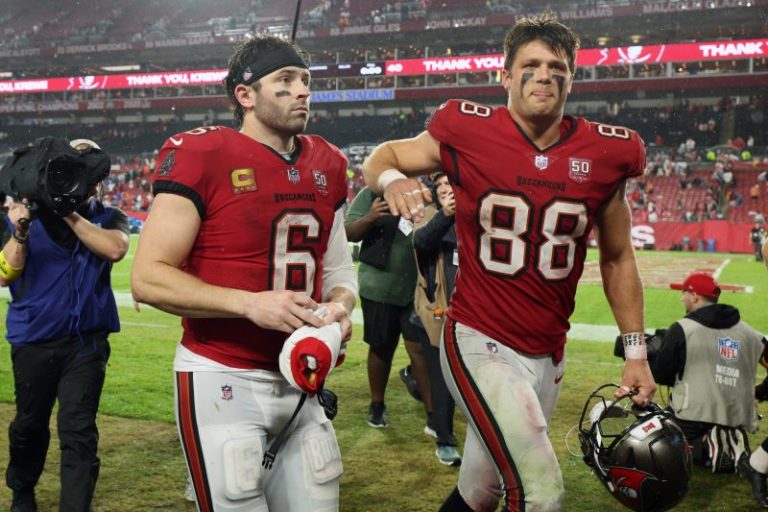

Jan. 3 provided further proof that the league knows what it’s doing – serving up a pair of matchups with massive postseason stakes. And even then, the schedule makers got another win – the Tampa Bay Buccaneers’ 16-14 defeat of the Carolina Panthers actually failing to decide the NFC South title (more on that later). On the other side of the country, the Seattle Seahawks dominated the San Francisco 49ers 13-3 to win the NFC west and the conference’s top seed.

Scoreboards aside, here are the winners, losers – and otherwise – from Saturday’s games:

Neither winner nor loser

NFC South

The Bucs and Panthers now knotted with 8-9 records, the winner of the division is still unknown. In a vacuum, Tampa Bay owns the common-games tiebreaker that puts the team in its near-perennial spot atop the division. But if the Atlanta Falcons create a three-way tie by winning Sunday, Carolina would get the tiebreaker by virtue of a 3-1 mark against the Falcons and Bucs, eclipsing the other two teams. The ironic aspect? Atlanta and the New Orleans Saints are clearly the division’s best squads at this point of the season.

WINNERS

Seattle Seahawks

Ironically, they’ve been a better road in their two seasons under coach Mike Macdonald. But the ‘Hawks have also won five in a row at Lumen Field, traditionally one of the most raucous venues in the league. Seattle has won 10 of its last 11 postseason games at home – though the loss, five years ago to the Rams, came in the Seahawks’ most recent playoff appearance in the Pacific Northwest. Still, if nothing else, the No. 1 seed not only afford that precious week off, it spares the Seahawks from a far-flung trip from the nation’s corner – and forces another team to possibly take a long flight there.

Sam Darnold

Who says he can’t win the big game? Like Seattle LB Ernest Jones IV said … well we can’t repeat what he said − but job well done, Sam.

Mother Nature

Still undefeated. The footing at Tampa’s Raymond James Stadium was bad, and it was evident as players slipped, kicks were affected, and the general quality of play was impacted in such a critical game.

Seattle D

The Seahawks limited the 49ers to three points − after San Francisco had averaged 42.3 over its previous three games. Enough said.

ESPN

The home of “Monday Night Football” continues to enjoy an expanded presence late in the season, broadcasting both of Saturday’s consequential duels with another to come during the wild-card round of the playoffs. A year from now, ESPN will have the Super Bowl for the first time – though it will be simulcast on ABC. And Disney’s NFL footprint is only likely to continue growing ahead of its pending deal to acquire NFL Network, RedZone Channel and other media assets owned and controlled by the NFL, the crossover between the entities already readily apparent.

Los Angeles Rams

They can move ahead of the 49ers and claim the fifth seed by beating the Arizona Cardinals on Sunday. Why is that important? It would convey a date with the sub-.500 NFC South champion. And, we know, the Panthers beat the Rams a few weeks ago – but we’re betting Matthew Stafford and Co. are ready to roll with real stakes hanging in the balance.

Atlanta Falcons

Hey, a team eliminated from postseason contention weeks ago now has something tangible to play for Sunday in its finale against the Saints. Not only might a season-ending four-game winning streak save this coaching staff but knocking off the Bucs in the process would be especially sweet.

Lavonte David

In what might have been the 14-year veteran’s final game – or at least the linebacker’s last one with the Bucs, his contract set to expire after the season – he recorded six stops Saturday to tie Hall of Famer Derrick Brooks as the most prolific tackler in franchise history.

Rico Dowdle

The Carolina running back, who ran for nearly 1,100 yards in 2024 for the Dallas Cowboys but was grossly undervalued by them and the free agent market has essentially matched that figure this season and earned a $1 million bonus Saturday by reaching 1,350 yards from scrimmage. Dowdle, who signed a $2.75 million contract with the Panthers before the season – and prior to hitting his incentive Saturday and others previously – should see a lot more green on the market a few months from now.

LOSERS

Rico Dowdle

With Carolina set up in the Bucs’ red zone early in the fourth quarter and trailing by nine, Dowdle slipped while tossing the ball back to QB Bryce Young on an apparent flea flicker. Fumble … and pretty much game, set and match. Tampa Bay didn’t actually convert the turnover into points but did burn nearly six precious minutes off the clock before getting a field-goal try blocked. (Regardless, Dowdle still gets to keep his milli.)

San Francisco 49ers

Not only did they fail to climb up to the top spot in the NFC, they could now drop to the sixth by Sunday night. Worse, QB Brock Purdy suffered a stinger near the end of the loss to Seattle and only has a week to get right before the Niners hit the playoff road.

Christian McCaffrey

A guy who was deservedly getting something of a late MVP push was responsible for a late turnover – unable to hang on to a Purdy pass near the goal line in the fourth quarter that turned into an interception – and one that effectively ended the Niners’ shot at that coveted No. 1 seed. ‘It’s a play that I absolutely have to make,’ McCaffrey said afterward.

Jason Myers

Seattle’s kicker missed two field goals, from 47 and 26 yards – not the kind of momentum you want to carry into the Super Bowl tournament.

Third quarter officiating in Tampa

Whether it was the lateral that was prematurely blown dead − though the officials still moved the Panthers back 7 yards − or the dubious offensive pass interference against Tetairoa McMillan, which wiped out his 32-yard reception, the zebras were especially unkind to Carolina as it tried to whittle down a 13-6 halftime deficit.

49ers offense

Kicking off Saturday without injured starters – especially studs like all-universe LT Trent Williams and WR1 Ricky Pearsall – was hardly an ideal way to take on the mighty Seahawks defense with so much hanging in the balance.

This post appeared first on USA TODAY